In the burgeoning ready-to-drink beverage category, alcohol-infused selections featuring legacy brands like Coca-Cola and Monster are proving to be a big opportunity as well as a merchandising challenge for c-stores.

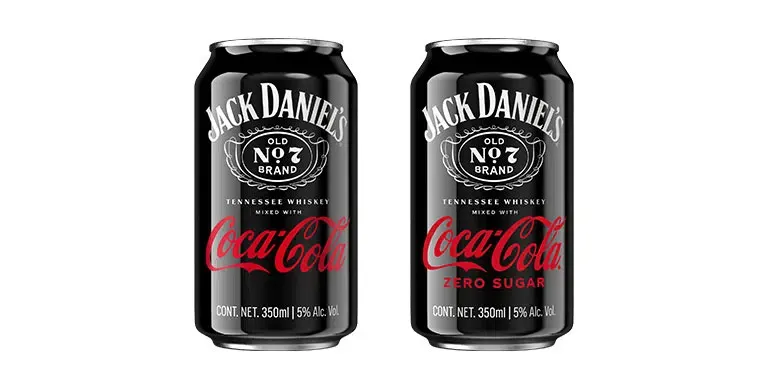

These “crossover” beverages started hitting shelves a few years ago and have so far been strong contributors for retailers, growing from $50 million in sales in 2021 to around $300 million currently, according to NielsenIQ data. Popular selections include Simply Spiked Lemonade, Arizona Hard Tea, Coca Cola with Jack Daniels and Monster Beast.

In the crowded RTD beverage space, these selections stand out by offering an edgy twist on well-known brands. They’re also getting a boost from the significant money big brands spend on marketing.

Crossover beverages are connecting with valuable shopper groups like Hispanic and Gen Z consumers. Many shoppers in their twenties have shunned or at least cut back on alcohol consumption, but a lot of them are willing to try crossover beverages, said Kaleigh Theriault, director of beverage alcohol thought leadership with NielsenIQ, during a presentation at the NACS Show in Chicago earlier this month.

“They are very familiar with a lot of these crossover brands because they grew up with them,” she said.

These beverages are part of a broader mash-up trend that’s happening across packaged products as big brands link up and move into new categories to generate excitement among shoppers. Hershey’s-owned Reese’s has a new peanut butter cup that contains pieces of Oreos, a brand controlled by Mondelez. Campbell’s sells a beer cheese soup made with Pabst Blue Ribbon beer, while Heinz has a pasta sauce infused with Absolut vodka.

Crossover alcoholic drinks generate higher sales on average than traditional canned cocktails, NielsenIQ data shows. Recently, some of these beverages, including Monster Beast and Topo Chico Spiked, moved into the top 50 sellers among RTD beverages.

“They are breaking into that space despite being just a fraction of the size, of the scale of some of these other brands on a national basis,” said Theriault.

Compliance and merchandising challenges

Nielsen counts 276 SKUs in crossover alcohol and expects that number to increase. As the category matures, c-stores should expect brands to cycle in and out of the category, making it important to closely track brand performance and be patient with availability from suppliers.

“It means you’ve got to stay agile,” said Jason Zelinski, vice president of convenience and growth accounts with NielsenIQ, during the NACS presentation. “As a category manager, you need to talk to your vendors and find what is appropriate for your shelf — but the customer is going to continue looking for that [product].”

Challenges are already showing up, said Zelinski, citing an 11% drop in sales of crossover beverages over the past year due to a pullback on supply and promotions from manufacturers. But this drop should be short-lived as vendors continue to innovate and as consumers continue to seek out these products.

“This is not a fad,” he said.

A potential pitfall that c-stores will want to avoid is consumer confusion. Because many of these crossover brands started in the nonalcoholic RTD space, it can be easy for shoppers to accidentally pick up the alcohol-infused version. Teriault and Zelinsky said retailers should clearly distinguish between the two segments and recommended stocking them in separate areas.

Doing so keeps retailers in compliance and also avoids the sort of accidental purchases that could irritate consumers.

“Making sure that your employees in your stores know what these products are and can talk about them, and that they're well signed, is going to go a long way,” Zelinski said.

Another challenge is that not all c-stores can sell all of these beverages. Due to state laws around alcohol sales, just 17% of c-stores can sell spirits. That includes spirits-based cocktails in many cases, though some states allow these drinks up to a certain alcohol by volume, Teriault said. Seventy-seven percent of c-stores are able to sell beer or malt-based beverages, making crossover drinks that incorporate those ingredients more widely available.

Countries outside the U.S. have also embraced the crossover beverage trend, with offerings like Sprite with vodka and the inevitable Bacardi rum and Coke on global shelves. Teriault and Zelinsky said well-known and nostalgic brands should continue emerging as beverage consumers continue to seek out buzzy new options.

“These consumers are always looking for what’s next, and the brand recognition that exists here is really important in driving sales,” Teriault said.