The 2025 NACS Show in Chicago was memorable, to say the least.

Not only did the association introduce its first new CEO in two decades during the expo, but retailers and suppliers from around the industry touted some of their biggest and boldest visions yet, from expansive store-growth plans to freshly made cuisine from around the globe. In the snack space, pickle flavoring was seemingly everywhere.

More than anything, though, this year’s NACS Show delivered several big-picture ideas that convenience retailers can inject into their businesses to spur profitability and repeat customers. C-Store Dive spent the past week taking notes on what stood out, and with the NACS Show now in the books, we’ve compiled our top highlights from this year’s event.

Here’s what we learned.

Bold and familiar flavors are a sweet spot for c-stores

Pickle was a flavor du jour at the 2025 NACS show. Items like Giant Snacks’ dill pickle cashews, Vlasic’s dill pickle balls, Flamin’ Hot dill pickle Cheetos and new spicy pickle Wavers snacks, highlighted ways the familiar, salty and sour flavor profile has found its home on shelves.

Sour flavors also got a lot of attention on the show floor. Hershey highlighted Sour Strips, a brand the company acquired last year and which represents its first foray into the sour category, according to company spokespeople at the booth, while Mars Wrigley showcased upcoming sour Extra gum. Beverages even got in on the act, with Coca-Cola showing off its sour fruit punch Fanta flavor in both carbonated and frozen varieties.

International flavors were heavily represented on the show floor and centered around items most American customers would know from their local Mexican or Asian restaurants. These included Mexican street corn bites from Rich Products; ready-to-eat chicken, barbacoa and pork pouches from Isadora; and beef, pork and chicken tacos from QSR chain Naughty Chile Taqueria.

Foodservice company International Food Solutions served up meals like chicken tinga, General Tso’s chicken, chicken teriyaki and tikka masala chicken, while c-store mainstay Core-Mark offered orange chicken and fried rice.

There are some bright ideas in store safety

Retailers at the NACS Show shared pain points on workplace safety and how they can improve it for their employees and customers.

Some operators are utilizing third-party vendors to help. Holiday Oil, which has 75 locations in Utah, partners with a company in Salt Lake City to provide assistance in the case of accidents. Workers press a button that connects them with a 911-certified operator, said Adam Walker, director of operations for Holiday Oil, during a panel.

“They’ll help [the worker] analyze the situation,” said Walker. “Help them create a plan. They can help them with first aid if needed. They can dispatch fire, EMS and police to the store.”

Meanwhile, Pilot Company gives workers an 800 number they can use to call a live nurse, who determines how to handle an injury at the store, said Mark Sorine, vice president of enterprise safety and security for the travel center company. Although this program has only been integrated into a couple stores, it will soon expand across the company, Sorine said.

In addition to general safety, operators dove into how to better prevent crime. Although industry players generally keep their data and secrets of success close to the vest, multiple experts agreed that retailers need to start sharing their crime-related data with one another to keep their stores safer.

“We’re not talking about working together on gas prices or on pricing strategies,” said Wes Pate, VP of loss prevention and risk management for Refuel Operating Company, during a panel discussion. “All that corporate secrecy should be kept secret. But we’re talking about crime, and it’s something that impacts all of us.”

Josh Nylander, EG America’s manager of retail asset protection investigations, agreed that sharing crime data would be useful for the c-store industry, since this info is universal. He said the Massachusetts company often participates in retail crime meetings with other brands and law enforcement, but finds that it’s often the only c-store retailer in the room.

“What’s good for somebody else is good for us,” he said.

Retailers need to figure out tech basics before jumping into AI

There’s a lot of technology for c-stores out there, and nowhere is that more obvious than on the showroom floor. Retailers can automate their forecourts or back office, install self-checkout kiosks and even look down the road toward the rise of AI.

But when retailers look at this sea of options and imagine all the changes they want to make, experts say it’s best to figure out the basics rather than potentially overwhelming themselves by jumping in the deep end.

Ideally, retailers should start with what challenge they wish to solve, said Chad Kobayashi, senior director of retail technology for Maverik, during a panel discussion on day three of the show. This can help prevent wasting money on products that sound useful but ultimately don’t address real needs.

Being thoughtful up front and re-evaluating technology after it’s been in use for a while can help companies build a tech stack that effectively serves both workers and customers.

Building a strong baseline is becoming more important than ever as technology continues rapidly evolving and reshaping consumer expectations. For instance, in the future, AI may change the entire process by which customers decide where to shop.

“The way technology is evolving, I can be driving, and I can tell my Google Maps, find me the cheapest gas, find me the best burger … and it will start to serve up options for where you should go,” said Christine Loukota, director of strategy and emerging technologies with Circle K, in a tech-focused roundtable.

These rapid changes can seem overwhelming — experts from Connexus shared a road map that includes AI-driven promotions, multi-retailer “super apps” and fully automated stores and delivery. But stores with a solid technology foundation will be better set up to connect their services to emerging innovations.

Competition is evolving

Convenience retailers are no longer just competing against each other. They’re also competing with businesses from other channels focused on key product categories.

One example is vape shops, which “grew their count by 40% between 2022 and 2023,” said Emma Tainter, research manager of analytics and programs for NACS, during a panel discussion at the NACS Show. Meanwhile, almost 1% of the c-stores stopped selling cigarettes in 2024, “largely due to what we’re seeing in terms of consolidation within the industry,” Tainter noted.

“But it is absolutely striking compared to the growth of vape shops, which increased by 10.6%,” Tainter said.

The other industry causing headaches for c-stores is coffee chains, according to three retailers who spoke on a panel discussion about the classic c-store beverage.

Micah Rupprecht, director of category management for foodservice for Kwik Trip, said that in the Wisconsin-based retailer’s markets, there’s either a local or national coffee chain opening “literally every day up the street” from one of its c-stores.

“They’re able to do a small footprint, small overhead, and they’re able to offer competitive drinks and marketing inside of that footprint,” Rupprecht said. “We’re trying to keep as many cups as we can inside our stores.”

This challenge also applies to Oxxo in Mexico, where it has tens of thousands of sites, said Ximena Reynoard, the retailer’s director of foodservice.

“If you see the price point, they’re closer to what we can offer,” Reynoard said of local coffee shops in Mexico. “They have very good quality [coffee] like us, and that’s why we need to be aware of them all the time and continue to say [how can we be] different from them?”

Beverage companies are really innovative

The beverage array at the 2025 NACS Show was full of new tastes, new formulations and new looks.

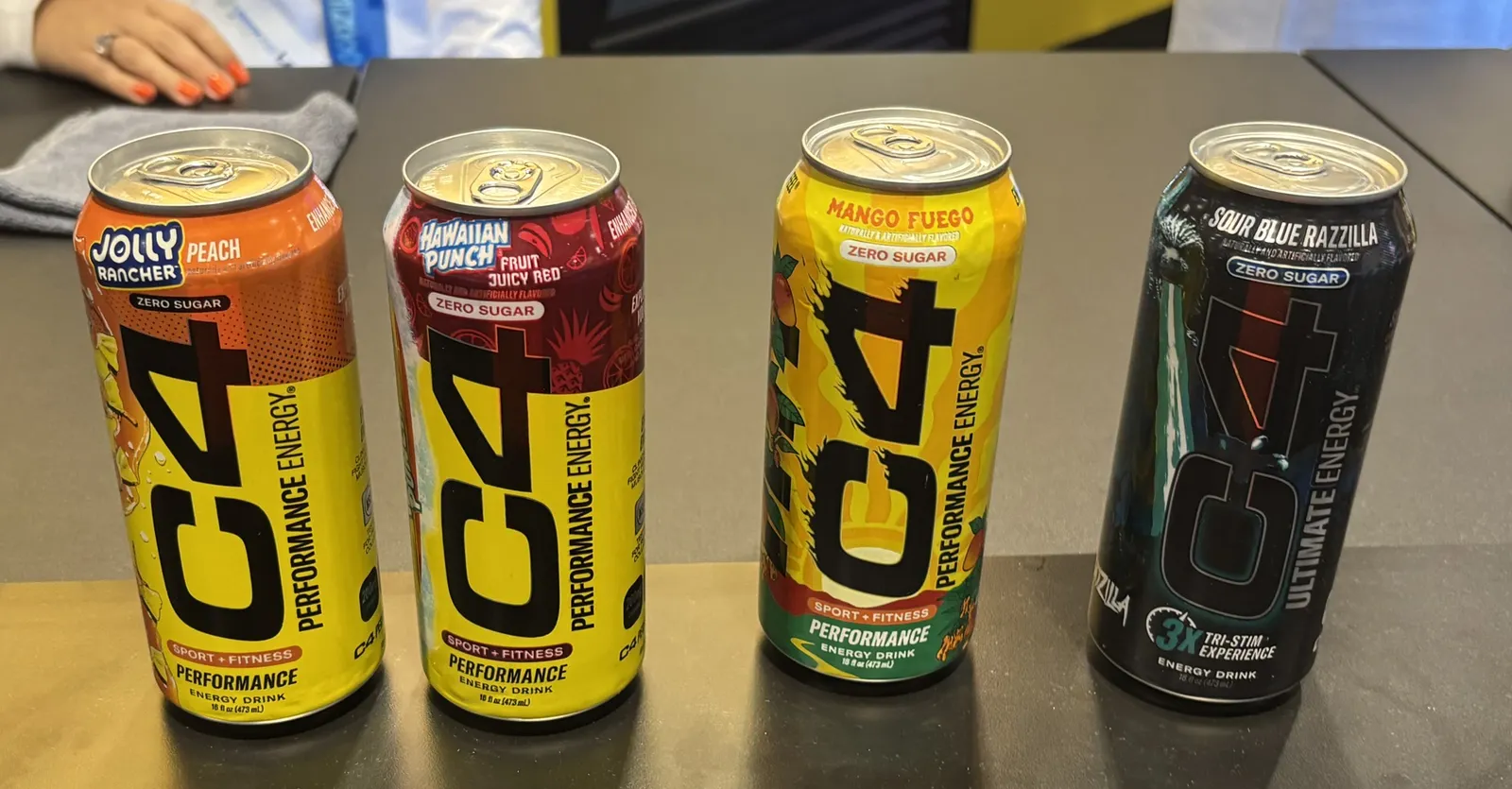

Flavor LTOs were on full display, including C4’s peach Jolly Rancher crossover, Coca-Cola’s Coke Cherry Float and Monster’s Ultra Red White and Blue Razz.

And while c-store retailers may be getting tired of hearing it, the wave of demand for functional and better-for-you drinks continues to grow. Clean ingredient energy drink makers like Bloom and King Kongin showed off their newest flavors. PepsiCo shared a reformulated Muscle Milk as well as Gatorade Lower Sugar, which should come out next year, and the 30-calorie Pepsi Prebiotic, which includes 3 grams of prebiotic fiber and comes in cola and cherry vanilla flavors.

Frozen beverages also came in a dizzying variety of flavors and options. Whether a visitor wanted frozen juices, teas, sodas, coffees or even alcohol drinks, some booth on the show floor had them covered.

Coca-Cola highlighted innovation in packaging, particularly the introduction of smaller 7.5-ounce cans for a more affordable treat and upcoming branding crossovers. To celebrate the FIFA World Cup next year, some Coke products will include collectible stickers depicting soccer players, while the brand’s celebration of the 250th anniversary of the signing of the Declaration of Independence will include unique cans designed for each state.