While alcohol sales have slumped in recent years, the pain is not shared equally over all parts of the industry. Some products are realizing a surge in sales, while others are continuing to lose category share in c-stores.

A record low 54% of Americans say they drink alcohol, according to a Gallup poll. “This coincides with a growing belief among Americans that moderate alcohol consumption is bad for one’s health, now the majority view for the first time,” Gallup said.

Broad cultural shifts — including more time spent at home, a heightened focus on wellness and the growing popularity of hydration — continue to influence drinking behaviors, said Samantha Bomkamp Des Jardins, content marketing manager for Datassential.

However, alcohol consumption actually realized a slight uptick in the first two quarters of 2025 following a steady decline throughout 2024, according to Datassential’s Buzz: Q2 2025 report, suggesting a potential rebound in consumer interest, Bomkamp Des Jardins said.

After talking with experts and crunching the numbers, C-Store Dive picked winners and losers in c-store alcohol.

Winners

Beer losing ground but still very popular

Even though c-store beer dollar sales declined 1.6% and case volume fell 3.8% for the 52 weeks that ended Aug. 10, per Circana data, it is still the top-selling food and beverage item in c-stores, said Mike Wyatt, principal for client insights at Circana. Beer and related items sold more than $25 billion in c-stores in the past year, according to Circana data.

Beer also remains the most widely consumed alcoholic beverage in the U.S., according to Datassential. Over 80% of beer drinkers enjoy it at least once a month, and more than half drink beer at least weekly.

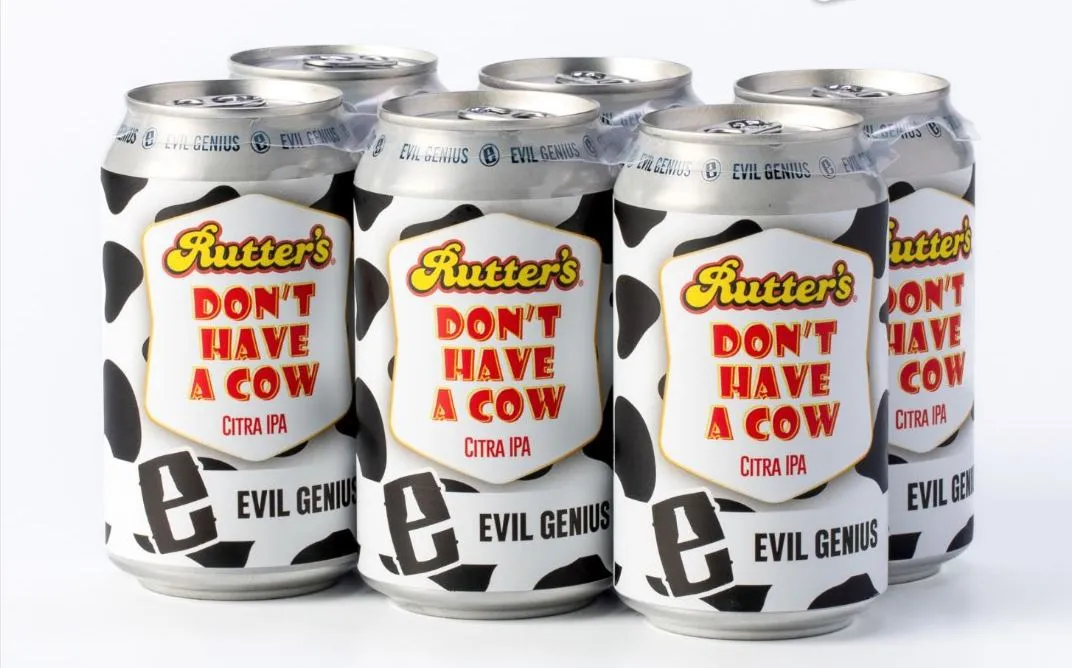

Import and craft beers are realizing some growth, performing “slightly better in all channels,” Wyatt said. The notable exception from that tepid trend is domestic super premium beer like Blue Moon or Michelob Ultra, which surpassed import and craft beer sales overall, driven by the success of a few top brands, Wyatt said.

On the other hand, beer category sales trends modestly decelerated in c-stores in the second quarter versus the first quarter of this year, according to a Goldman Sachs retailer survey in Q2. As a result, c-store retailers have a more tempered outlook for the category this year.

RTDs, spirits sales soar

Ready-to-drink alcoholic beverages and canned cocktails have been almost solely responsible for the increase in c-store alcohol sales in recent years. More than half of consumers say they have purchased more of these products over the past two years, reflecting increasing demand for convenience and variety, Wyatt said.

Hard seltzers, such as White Claw and Bud Light Seltzer, have seen “remarkable” growth of 453% over the past four years.

Premixed cocktails, such as Buzzballz and BeatBox, have been outperforming the overall alcohol category as well as hard seltzers and flavored malt beverages, Wyatt noted. In fact, sales of premixed cocktails skyrocketed nearly 56% in c-stores for the year that ended Aug. 10, while case volume hiked by 66.5%.

Spirits are also more popular across all types of retailers.

Tequila has performed especially well, with sales up 13.8% year over year due to increased quality, enhanced flavor profiles and mixology versatility, Wyatt said.

“Tequila has become the go-to spirit for many consumers who previously drank whiskey as well as newcomers looking to explore a bit, which is further supported by robust growth of tequila across several price points,” he said.

Losers

Wine sales continue freefall

Sales of wine have been sliding across all types of retail outlets in recent years, and c-stores are no exception. Dollar sales for the category over the past year dropped 4.3%, while case sales declined 7%, Circana said.

Part of the problem is wine has more of an “inherent planned purchase” aspect than beer and RTDs, which does not necessarily align with the wine assortment at most c-stores, Wyatt said.

Further dampening sales is the fact that assortment at c-stores has declined 16% over the past 36 months, compared to 9% for all types of alcoholic beverages, per Circana.

“This is driven to a high degree by c-store operators aligning their assortments to match consumer preferences and overall trends, and understandably so,” Wyatt explained, “but it has exacerbated the already negative wine trend.”

Non-alcoholic wine, beer remain niche

While low- and no-alcohol beverage sales continue to climb, c-stores are not seeing as significant a gain as other retailers, Wyatt said. For example, low alcohol/no alcohol beer now accounts for 2.5% of total beer sales across all channels, up from 2% a year ago but makes up only 0.3% of sales in c-stores.

A similar dynamic exists on the wine side, Wyatt said.

Overall non-alcoholic beverage purchases have stabilized, suggesting it is “a mature and consistent category,” Bomkamp Des Jardins said.

While some categories are performing better than others currently, Wyatt cautioned against writing off those sub-categories entirely.

“While alcohol sales are not reaching the growth levels of years past, it remains a very important macro-category for consumers and retailers and the overall macro-category is still strong,” Wyatt said. “We have just seen shifts within alcohol that make certain segments seem like they are on the decline, but they tend to bounce back as consumer tastes and preferences change and new consumers enter the category.”