Independent convenience stores have always relied on grit and adaptability. Heading into 2026, adaptability alone is no longer enough. Costs across labor, inventory, and operations remain elevated. Traffic patterns are less predictable and margins are tighter, leaving little room to recover when things do not go as planned. For many operators, the past year was not defined by growth or decline but by volatility.

That reality has shifted how retailers approach growth. Selling more still matters, but many operators are paying closer attention to how efficiently the business runs and how much value they are getting from the sales already coming through the door. That shift is influencing how independent retailers evaluate programs, partners and priorities.

WAM Group operates with a front-row view of those pressures. As a national collective of 24 independent wholesale distributors supporting approximately 25,000 independent and small-chain retailers, WAM sits where national programs meet store-level execution. Distributor partners and sales consultants are in stores every day, seeing where programs become difficult to manage and where adding the right tools can strengthen performance. That perspective comes from 40 years of navigating market cycles and from seeing, just last year, how the right program mix returned more than $13 million to retailers through rebates.

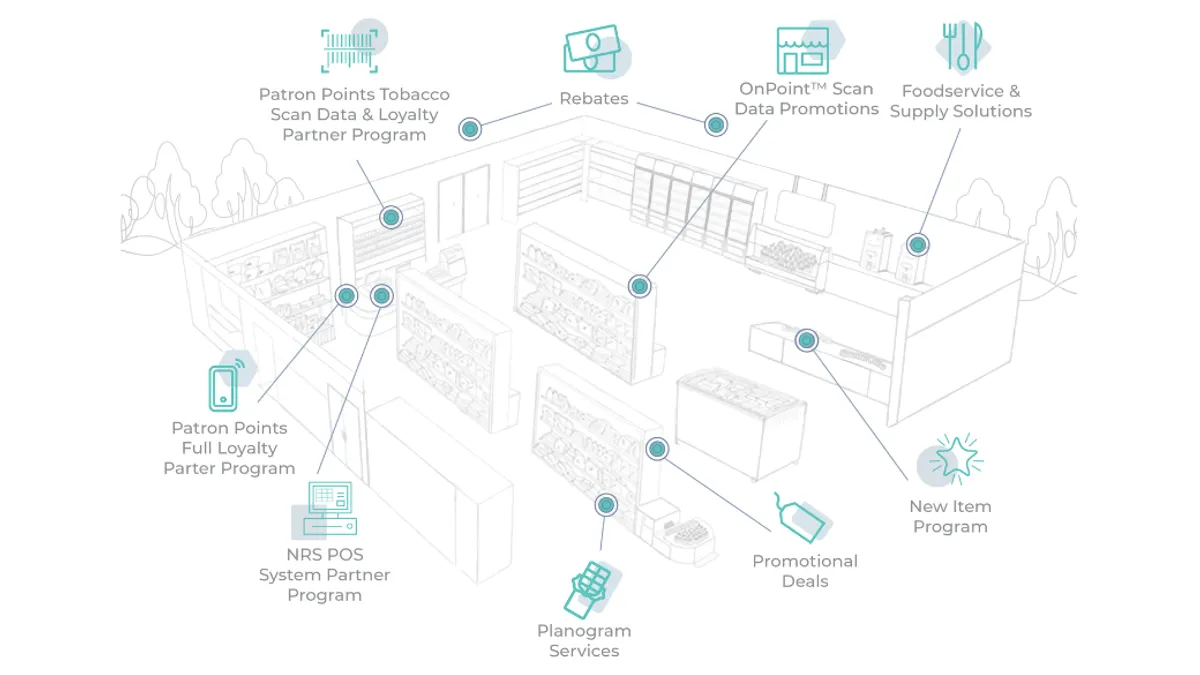

At WAM, C-Store Solutions are approached as a connected system rather than individual offerings. They are designed to reflect how independent stores operate day to day, supporting how products are launched, promoted, tracked and sold without adding unnecessary complexity. The goal is not to add more initiatives, but to help retailers align the right programs and execute them consistently through distributor relationships they already trust.

Looking back at 2025, what separated stronger stores was using the right tools. Stores that had clearer visibility into what was working and fewer disconnected programs found it easier to manage rising costs and uneven traffic. When core categories were run consistently, protecting margin became more manageable.

Food service illustrates this shift clearly. For independent operators, food service has moved beyond a complementary category to become a meaningful driver of inside profit. Industry data shows it now represents nearly 30% of inside sales and close to 40% of inside gross margin dollars. Even as traffic patterns shifted in 2025, foodservice remained resilient, reinforcing its importance heading into 2026.

Promotions and rebate programs also remain important, though they serve different purposes. Brand-funded rebate programs allow retailers to earn back on products they already sell, providing value tied to everyday sales. Throughout 2025, retailers leaned on these supplier-funded programs as unit growth varied by category. When rebates are turnkey, they become dependable contributors rather than one-off opportunities.

Scan data backed promotions add another layer by helping retailers influence impulse purchases and basket size while clearly showing what is working at the register. When paired with distributor support and simple tracking, these programs make it easier to run promotions with confidence.

Loyalty builds on all these efforts. Beyond driving repeat visits, loyalty programs have become one of the most effective ways for retailers to understand shopper behavior and shape more relevant promotions. In 2025, many retailers began using loyalty insights to see which offers resonated, what drove return trips and how foodservice and promotions influenced purchasing patterns. Through its partnership with Patron Points, WAM supports loyalty programs that help retailers connect tobacco incentives, promotions, food service and customer engagement in a more coordinated, data-informed way to drive sales.

At the end of the day, stores need clarity in how everything runs. As technology expectations rise, retailers are looking for systems that make the day easier, not more complicated. That usually starts with point-of-sale and back-office tools that cut down on manual work and make it clearer what’s happening in the store. Platforms like National Retail Solutions reflect the shift toward practical technology that works for independent operators, not against them.

The takeaway heading into 2026 is not to expand broadly but to better leverage existing resources and tools offered across supplier ecosystems. Strengthening core categories, advancing foodservice within existing footprints, using rebate and promotional programs intentionally, leveraging loyalty insights and relying on systems that support consistency can help retailers move forward with confidence.

Together, these capabilities form WAM’s C-Store Solutions, a distributor-led umbrella designed to support independent retailers through coordinated programs and trusted local partnerships. Retailers interested in learning more can visit https://wamresults.com/wam-retailer.